Struggling to keep up with the rapid changes in AI detection tools? The market is booming, with new players entering and shaking things up. This blog explores emerging competitors in the AI detection market and their strategies to stand out.

Stay tuned; there’s a lot you wouldn’t want to miss!

Key Takeaways

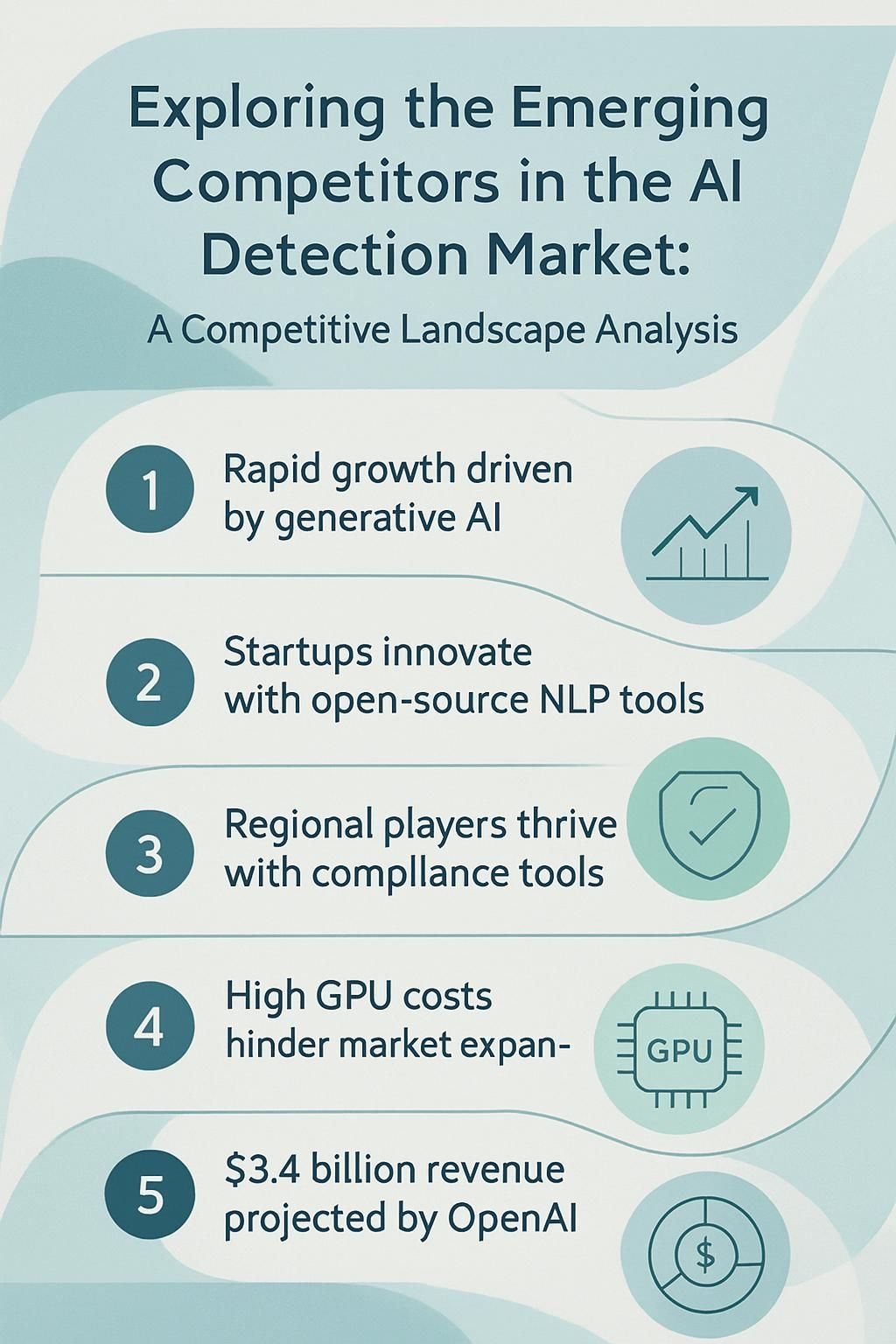

- The AI detection market is growing fast, fueled by the rise of generative AI and demand for real-time solutions. Key players include Google, Microsoft, Amazon, and startups like Groq and DeepSeek.

- Startups like Hugging Face lead in innovation with open-source tools for NLP. Big companies focus on advanced chips (e.g., Google’s TPU) to boost speed and efficiency.

- Regional players are gaining traction in Asia-Pacific and Europe by offering affordable or regulation-compliant tools. China’s DeepSeek excels in AI hardware innovations.

- Challenges include high GPU costs, evolving cybersecurity threats, and compliance with strict global regulations such as EU laws like GDPR.

- By 2025, major investments from companies like OpenAI ($3.4 billion projected revenue run-rate) could reshape competition while focusing on generative AI integration across industries.

Overview of the AI Detection Market

The AI detection market is growing fast, driven by more industries adopting smart systems. Businesses now need better tools to handle risks and spot threats quickly.

Market segmentation by type and application

The AI detection market isn’t a one-size-fits-all industry. It’s split into various types and applications, creating a dynamic landscape. Each segment targets specific needs, making it easier for businesses to understand opportunities. Below is how the market breaks down:

| Segmentation Type | Description | Examples |

|---|---|---|

| Detection by AI Model | Focuses on identifying outputs from specific AI models like GPT or BERT. | AI-authored content detection, plagiarism tools. |

| Application-Specific | Targets industries like cybersecurity, education, and healthcare. | Fraud detection in finance, academic essay verifiers. |

| Real-Time Detection | Offers solutions for live monitoring and instant identification. | Video or livestream moderation tools. |

| Technology-Based | Segments tools by the tech used, like machine learning or NLP. | Spam filters, fake text detectors. |

| Hardware-Specific | Platform-optimized systems relying on AI-focused hardware. | NVIDIA GPUs, AMD accelerators. |

Each segment answers a different question. Some dig into AI-generated content, while others focus on fraud or machine-generated spam. Hardware-based solutions bring speed and efficiency. These layers help companies play their cards right, boosting competitive advantage.

Key drivers and challenges in the industry

AI detection tools are growing fast because of demand for real-time solutions. Companies want systems that can spot risks and threats quickly. The rise of generative AI has sparked interest in advanced detection technologies.

Cloud platforms, like Amazon Web Services (AWS), make it easier to access these tools globally. Advancements in machine learning models and deep learning also improve accuracy.

On the flip side, challenges loom large. High costs of graphics processing units (GPUs) and AI chips create barriers for smaller players. Regulatory compliance adds complexity as governments push for stricter AI ethics policies.

Cyber threats continue to evolve, pushing companies to upgrade constantly or risk falling behind competitors. Balancing innovation with security remains a tightrope act in this competitive market.

Emerging Competitors in the AI Detection Market

Fresh faces are shaking up AI detection, bringing bold ideas and cutting-edge tech. Big names are jumping in too, eager to claim their share of this booming market.

Startups disrupting the market

Innovation is shaking up the AI detection market, and startups are leading the charge. They bring fresh ideas, bold strategies, and advanced technologies to compete with bigger players.

- Groq: This startup is making waves with its cutting-edge chip architecture. Its chips perform real-time AI inference faster than many established brands.

- DeepSeek: Focusing on affordability, DeepSeek designs cost-effective AI hardware solutions. It targets businesses looking for powerful options without breaking the bank.

- Hugging Face: Known for open-source tools, Hugging Face boosts accessibility in AI technologies. Its focus on natural language processing (NLP) puts it ahead of competitors in conversational AI.

- Anthropic: This company aims to create safer generative AI models like Claude 2 while addressing ethical concerns around machine learning systems.

- Stability AI: Building upon generative adversarial networks, Stability AI develops customizable image recognition tools for industries like marketing and automation.

- Snorkel.ai: Aiming to speed up data labeling processes, Snorkel.ai introduces software that reduces manual work in machine learning projects.

Their innovative approaches are transforming artificial intelligence landscapes rapidly; established companies must adapt fast to keep pace!

Established companies entering the space

Big players are stepping into the AI detection market. Their entry shakes up competition and speeds up innovation.

- Google is a front-runner with its TPU accelerators. These chips make AI tasks faster and more efficient. They also support advanced features like visual recognition and threat detection.

- Amazon is making moves with its Inferentia and Trainium chips. These power AWS services, offering strong performance for machine learning tasks in the cloud.

- Microsoft integrates AI technology into Office 365 and Azure. Its focus on generative AI, such as GPT-4, strengthens its tools for fraud detection and customer engagement.

- Apple uses its own AI chips for face recognition and industrial safety applications. This gives it an edge in mobile technology markets.

- Meta boosts its AI game through innovations in deep learning models like foundation models, shaping the way information is processed online.

- Qualcomm (QCOM) focuses on mobile tech with AI solutions for predictive analytics, risk management, and automotive artificial intelligence.

- NVIDIA (NVDA) invests heavily in advanced micro devices for machine learning; it leads in deep learning tasks across industries like robotics or industrial automation.

The next section uncovers how startups challenge these giants by disrupting the status quo!

Regional players gaining traction

Regional players are shaking up the AI detection market. They bring fresh ideas and strong local understanding, challenging global giants.

- Chinese company DeepSeek has made waves. It uses fewer high-end AI chips while achieving top-tier performance. Its techniques, like reinforcement learning and model distillation, give it an edge.

- India is seeing innovation too. Local startups focus on affordable AI tools for fraud detection and predictive maintenance. Their solutions address growing demand in industries like banking and healthcare.

- Southeast Asia is advancing quickly. Companies here develop AI for facial recognition technologies and real-time monitoring, meeting regional security needs.

- Brazil and Mexico highlight Latin America’s progress. Regional providers there create tools specifically for cloud-based access in businesses, improving operational efficiency.

- In Europe, mid-size firms prioritize data privacy in AI products. This approach aligns with strict EU regulations like GDPR, building trust among local clients.

These players are finding success through smart strategies and unique solutions tailored for their home markets!

Competitive Strategies of Emerging Players

New players in AI detection are shaking things up with bold moves. They’re finding clever ways to stand out, using tech smarts and fresh ideas.

Focus on innovation and technology

Startups like Groq and DeepSeek are redesigning AI hardware. They focus on cutting costs by shifting from training models to inferencing. This smarter approach helps reduce expenses while speeding up processes.

Tech giants like Microsoft and Google invest heavily in AI integration. With tools like AI Copilot and Hugging Face platforms, they aim to improve accuracy and efficiency in detection systems.

These advancements push the boundaries of machine learning, making detection faster and smarter for real-world applications.

Strategic partnerships and collaborations

Companies join forces to stay ahead in the AI detection market. Nvidia has expanded through “sovereign AI” deals, securing a stronger hold with cloud providers and governments. These collaborations help businesses access advanced AI infrastructure and tools.

Microsoft made waves by pouring $14 billion into OpenAI. This move solidified its position as a leader in AI-based solutions like predictive maintenance and fraud detection. Partnerships like these drive faster innovation, integrating deep learning technologies into everyday applications.

Pricing and differentiation strategies

New competitors use pricing as a weapon in the AI detection battle. Some startups offer lower prices to stand out, luring customers from big players like Microsoft and OpenAI. Others bundle services, such as cloud access or predictive maintenance tools, for better value.

Discounts and free trial periods sweeten the deal further.

Differentiation pushes innovation to the forefront. Players like Google focus on advanced machine learning models, while smaller regional companies target niche markets with localized solutions.

Adding features like real-time fraud detection or clinical decision-support sets them apart too. Hugging Face uses open-source tools to attract a developer-driven audience, carving its own lane in this crowded space.

Trends Shaping the AI Detection Market

Tech is moving fast, and AI detection tools are growing smarter, sparking fresh demand—read on to spot what’s driving this change.

Advancements in machine learning and NLP

Machine learning has grown leaps and bounds. It now powers predictive models for fraud detection, risk management, and even clinical trials. Tools like Microsoft’s Azure AI and Google’s TensorFlow lead innovation by crunching vast amounts of data faster than ever.

Natural language processing (NLP) is also advancing at lightning speed. Hugging Face uses NLP to improve sentiment analysis, translation, and chatbots. Generative AI tools like OpenAI’s models simplify human-like text creation in marketing campaigns or electronic health records.

These strides reshape how companies process language data efficiently while integrating into other tech sectors such as cloud services or AI chips.

Next up: Integration of generative AI in detection tools…

Integration of generative AI in detection tools

Generative AI adds a sharp edge to detection tools. It creates realistic text, images, and code, which helps catch fraudulent activities faster. For example, companies like OpenAI and Google use deep learning in detection systems to flag risks or unusual patterns quickly.

Tools powered by generative AI also understand predictive maintenance needs better. They analyze data in real-time for errors before they spiral out of control. This boosts performance for North America’s AI market leaders like Microsoft and Amazon Web Services (AWS).

Growing demand for real-time detection solutions

Businesses want faster responses to problems. Real-time detection tools make this possible. These systems spot issues as they happen, saving time and money. For example, CoreWeave’s strong AI infrastructure supports quicker analysis in various industries.

Companies like Groq also build advanced chips for instant AI processing.

Fast detection helps with risk management and predictive maintenance in critical areas. It guards against system failures before they escalate. Tech giants such as Microsoft and Google invest heavily in these solutions due to this demand, pushing the market forward rapidly.

Regional Insights on the Competitive Landscape

North America continues to lead, with strong innovation and big players pushing ahead. Meanwhile, Asia-Pacific is growing fast, fueled by fresh investments and tech advancements.

North America as a leading region

The United States dominates the AI detection market in North America. C3.ai holds 77.50% of its customer base in this region, showing strong adoption. Major companies like AWS, Google Cloud, and Microsoft Azure lead with their AI infrastructure and cloud services.

These platforms support predictive maintenance, deep learning tools, and real-time detection solutions.

Big tech firms including MSFT and Amazon have invested heavily here due to high demand for artificial intelligence applications. The region benefits from venture capital backing innovative startups and established players alike.

Rapid innovation continues to fuel competition among businesses entering the space, especially in machine learning advancements driving growth worldwide. Moving eastward highlights how Asia-Pacific markets are picking up speed.

Rapid growth in Asia-Pacific markets

North America may lead, but Asia-Pacific is sprinting ahead. Countries like China are investing heavily in artificial intelligence and AI infrastructure. China’s DeepSeek shines with its breakthroughs in AI hardware.

The nation has bold goals, aiming to dominate the AI market by 2030.

Demand for predictive maintenance and risk management tools is also surging across regions like India and South Korea. Companies such as Baidu are pushing advancements in generative AI solutions.

This growth attracts global players while fostering strong regional competition among tech firms looking to tap into this booming market.

Emerging opportunities in Europe and Latin America

AI regulation in Europe creates openings for compliance-focused tools. With the EU tightening its rules, businesses need AI that aligns with these standards. Open-source models like Meta’s LLaMA and BLOOM are gaining traction here due to their adaptability and cost-effectiveness.

Companies offering predictive maintenance or risk management powered by artificial intelligence can tap into this rising demand.

In Latin America, growing industries like retail and healthcare fuel interest in real-time detection solutions. Countries such as Brazil focus on AI integration to boost efficiency and cut costs.

Regional startups are leveraging deep learning technologies to meet local needs while keeping prices competitive. This market shows potential for rapid expansion driven by increasing investment in AI infrastructure across sectors.

Comparative Analysis of AI Detection Tools

AI detection tools don’t all play in the same league. While some set benchmarks, others struggle to make a mark. Below is a breakdown of the key players based on market share, features, and strategies.

| Tool/Company | Market Share (%) | Strengths | Challenges |

|---|---|---|---|

| Trustwave | 17.69 |

|

|

| Forcepoint Triton APX | 11.34 |

|

|

| DomainTools | 9.35 |

|

|

| C3.ai | 0.32 |

|

|

Each tool brings something to the table. Some rely on legacy strength, others push innovation. Gaps, however, create opportunities for new entrants.

Future Outlook for the AI Detection Market

The AI detection market is set to explode, with fresh players and smarter tools reshaping the game—stay tuned for what’s next!

Predicted market growth and new entrants

The AI detection market could experience steady growth despite a slowdown in AI stocks by 2025. Big players like Amazon Web Services, Microsoft, and Google continue to lead with significant investments.

Mid-sized challengers are also intensifying their efforts, focusing on generative AI integration and advanced machine learning tools.

Startups may bring fresh competition by targeting specific areas overlooked by giants. Regional companies in Asia-Pacific are advancing quickly as a result of substantial government support and increasing demand for AI infrastructure.

Europe also offers opportunities as countries tighten regulations around AI technologies like OpenAI’s tools or Meta’s solutions customized for policymakers and advertisers alike.

Strategic opportunities for stakeholders

Stakeholders in the AI detection market have clear chances to benefit from rapid growth. With OpenAI projecting $3.4 billion annual revenue run-rate by May 2025, investing early in research and development or partnerships with firms like Amazon Web Services (AWS) could yield significant returns.

Salesforce’s $8 billion acquisition of Informatica highlights how mergers shape the market. Smaller players may focus on machine learning innovation while large companies like Microsoft or Google expand their tools’ reach using artificial neural networks.

Real-time solutions, boosted by generative AI demand, open doors for new entrants to compete effectively and attract attention globally.

Conclusion

The AI detection market is buzzing with fresh players and bold moves. Startups, giants like Microsoft, and regional powerhouses are all shaking things up. Innovation in AI chips, generative tools, and machine learning keeps the game exciting.

Smaller models now give new developers a fighting chance too. The race is on, and the winners will shape tomorrow’s tech world.

For an in-depth analysis on how emerging AI detection tools stack up against established options, check out our comparison of GPTZero and Turnitin AI.